Lasting Power Of Attorney

Key Takeaways

-

Plan ahead with a Lasting Power of Attorney to safeguard your interests and for peace of mind

-

Appoint someone you trust to make decisions and act on your behalf should you ever lose mental capacity

-

A family member is not automatically given the right to make legal decisions on your behalf should you lose mental capacity. This can hinder their ability to care for you

Many of us actively plan ahead for the future by saving up, investing and buying insurance.

We do this because we want to be sure that we are prepared for a rainy day. We also want to be sure that we do not inconvenience our family members too much when they care for us in the future.

However, how many of us actually plan for the possibility that we may lose our mental capacity?

What Is A Lasting Power Of Attorney (LPA)?

An LPA is a legal document that lets you (the donor) appoint one or more people you trust to be your donees. They will act and make decisions on your behalf should you lose mental capacity one day.

You must be 21 or older and have mental capacity to make your LPA.

Your donees can be appointed to act in two broad areas:

-

Personal welfare; and

-

Property and affairs

What If You Do Not Have An LPA?

If you do not have an LPA and you lose mental capacity, your family member is not automatically given the right to make legal decisions on your behalf. This can hinder their ability to care for you.

As they have not been legally appointed to do so beforehand, they may face difficulties trying to:

-

Make care arrangements;

-

Manage your bank accounts and properties; or

-

Decide how best to use your funds for your day-to-day needs.

Your family member will have to apply to Court to be appointed as your deputy before they are authorised to make decisions and act on your behalf.

Compared to making an LPA, the deputyship application process will not only take longer to complete but will also cost more.

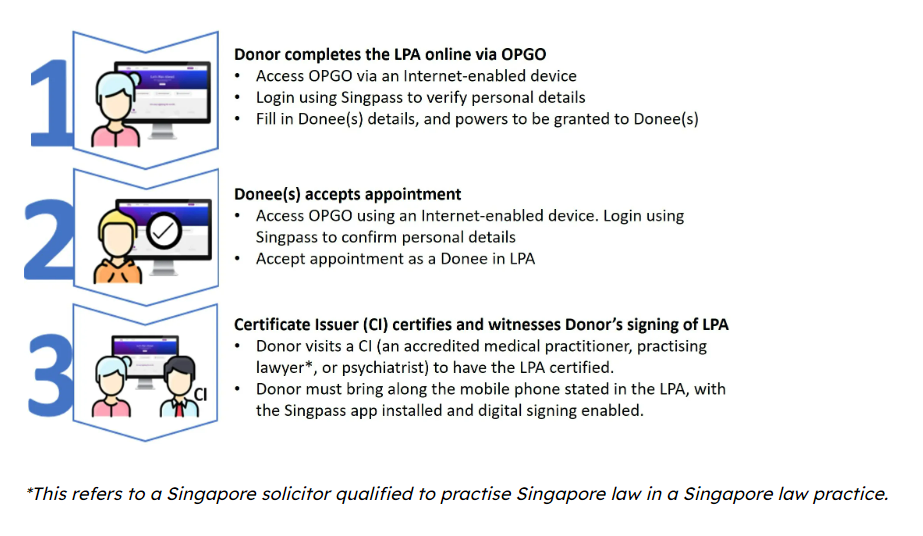

Three Steps To Make An LPA

Infographics from Office of the Public Guardian.

All LPAs must be made and submitted via the Office of the Public Guardian Online (OPGO).

Information on exceptional situations where hardcopy LPA may be used can be found here.