Basic Financial Planning Guide for Fresh Entrants to the Workforce

You are in the pink of health, between the ages of 19 - 29 years old, and taking your first steps into the working world. This is the best time to start building a strong foundation for your long-term goals.

|

Key Needs |

Rules of Thumbs |

What to Do |

|---|---|---|

|

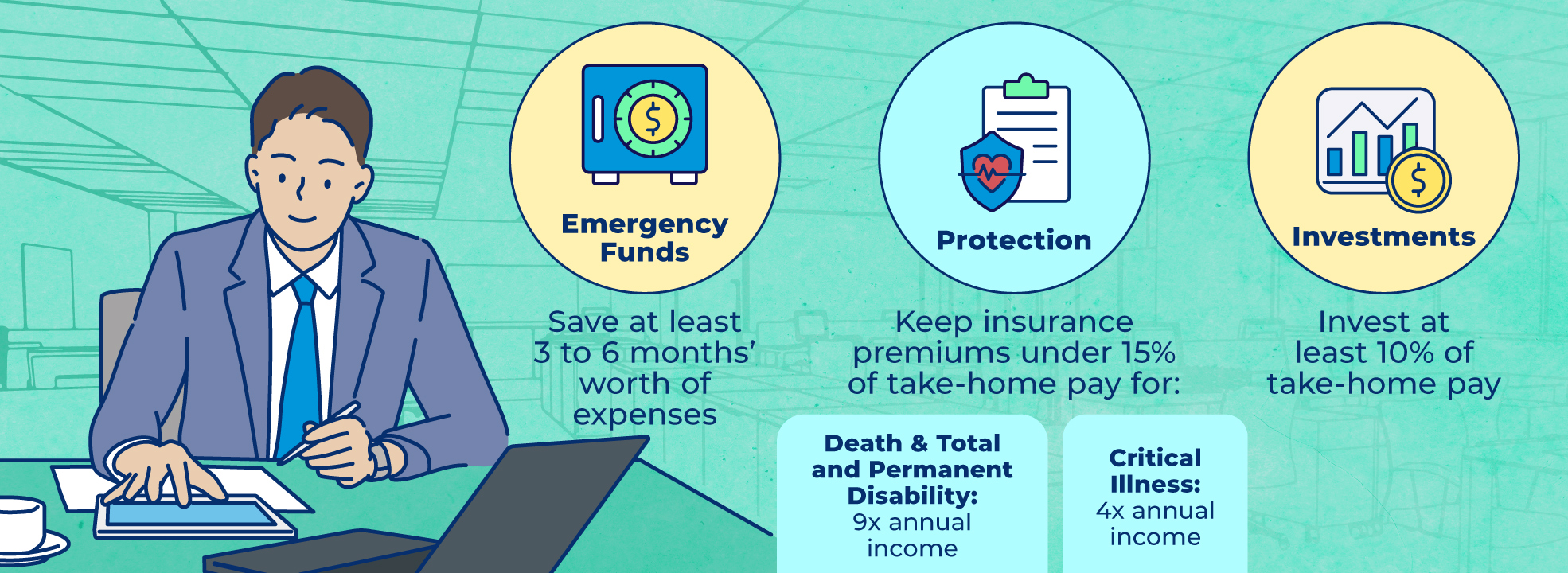

Emergency Funds |

Set side at least 3 to 6 months1 worth of expense |

Consider keeping money in a combination of:

*SSBs are guaranteed by the Government. You can exit your investment in any given month without penalty |

|

Protection |

Obtain insurance protection for:

Familiarise with national scheme, MediShield Life, that have you covered for large healthcare bills Spend at most 15% of take-home pay on insurance protection |

Consider Term Insurance Plans for affordable protection Scan to compare insurance products go.gov..sg/compare |

|

Investments |

Invest at least 10% of take-home pay for retirement and other financial goals (e.g., wedding, home purchase)

|

Consider:

|

Case Study

John, 23, recently graduated and started working in retail sales. He lives with his parents but plans to settle down with his girlfriend and buy a home in 5 years. Here’s a breakdown of his monthly cashflows for financial planning.

|

Monthly Salary |

$2,500 |

|---|---|

|

Employee CPF Contribution (20%) |

$500 |

|

Monthly Take-home Pay |

$2,000 |

|

Financial Planning Budget |

$600 |

|

Monthly Expenses |

$1,400 |

Breakdown of Monthly Financial Planning

|

Financial Planning Needs |

Rules of Thumb |

Product(s) |

Amount per month |

|---|---|---|---|

|

Emergency Funds |

6 x $1,400 = $8,400 |

|

$3501 |

|

Protections |

Large healthcare bills |

|

$21 from CPF2 |

|

Death & Total Permanent Disability (TPD) 9 x $2,2500 x 12 = $270,000 |

|

$2 from CPF3 $154 |

|

|

Critical Illness 4 x $2,500 x 12 = $120,000 |

|

$355 |

|

|

Investments |

At least 10% x $2,000 = $200 |

|

$1006 |

In 5 years, John would have prepared more than $40,0007 for his home purchase |

$100 |

||

|

TOTAL out-of-pocket = $600

|

|||

1.John has already saved $3,000 having worked part-time previously and from serving national service. He will save the recommended amount of 6 months’ expenses ($8,400) in slightly over one year.

2. Based on actual MediShield Life premiums (before subsidies) of $254.67 (annual) or $254.67/12= $21.22 (monthly) according to

https://www.cpf.gov.sg/content/dam/web/member/healthcare/documents/MediShield%20Life%20Premiums%20by%20Age%20Group.pdf. MediShield Life premiums are payable yearly using CPF. Premiums also

increase with age.

3. Based on actual DPS annual premiums of $18 (coverage of up to $70,000 until age 60) or $18/12= $1.5 (monthly), according to https://www.cpf.gov.sg/member/faq/account-services/dependants--protection-

scheme/how-much-premium-do-i-need-to-pay-to-be-covered-under-dps. DPS premiums are payable yearly using CPF. Premiums also increase with age.

4. Based on estimated annual median prices of term insurance plans for coverage until age 65 according to www.comparefirst.sg. Please note that coverage is in multiples of $100,000, rounded up or down depending

on the individual’s estimated insurance protection needs.

5. Based on estimated annual median prices of standalone term insurance plans which minimally cover the 37 critical illnesses defined in LIA’s Critical Illness Framework.

6. John invests remaining funds available.

7. $6,000 in T-Bills & $34,504.80 in his CPF OA, excluding interests and assuming no change in his salary for

Find out more for fresh entrants to the workforce

Emergency funds

To work out how much you need in emergency funds, compile your household and personal expenses in a month, including loan repayments, credit card bills, insurance premiums, and taxes. When budgeting for your expenses, a useful tip is to separate the essentials from the good-to-haves. Aim to set aside enough to cover at least 3 to 6 months’ worth of expenses. If your income is irregular, aim to have savings equivalent to 12 months of expenses.

Prioritise paying off high interest debts (e.g., credit card bills), to avoid high interest charges

MediShield Life

MediShield Life is a national health insurance that covers large hospital bills and selected costly outpatient treatments such as cancer treatments and dialysis. All Singapore Citizens and Permanent Residents are covered by MediShield Life and premiums can be fully paid using your MediSave. If you prefer to choose your own doctor, or opt for private hospitals or Class B1/A wards in public hospitals, your hospital bill would be larger. Private insurers offer Integrated Shield Plans (IPs)*, which provide additional coverage on top of MediShield Life to help with your out-of-pocket expenses. When making a decision to buy an IP, evaluate your needs and be mindful of the long-term costs that increase significantly with age. You can use MediSave to cover IP premiums, but it has withdrawal limits. If your IP premium(excluding MediShield Life) exceeds these limits, you may need to pay a portion using cash.

Half of Singapore residents with IPs do not utilise their IP benefits fully by choosing to stay in Class B2/C wards when hospitalised. In such cases, MediShield Life’s coverage would be sufficient and additional IP may not be necessary.

|

Check out MOH's comparision of IPs |

/insert QR code go.gov.sg/compareip |

*IP policyholders are also not eligible for Additional Premium Support (APS), which is a form of financial assistance for MediShield Life/CareShield Life premiums. If you are currently receiving APS to pay for your MediShield Life and/or CareShield Life premiums, you will stop receiving APS if you choose to be insured under an IP. This applies even if you are not the person paying for the IP.

Coverage for death, total permanent disability and critical illness

The Life Insurance Association of Singapore recommends coverage of:

-

9x annual income for death and total permanent disability; and

-

4x annual income for standard critical illness

Dependants’ Protection Scheme (DPS) is a term life insurance scheme that provides a one-off payout (up to $70,000 until age 60; up to $55,000 from above age 60 to 65) in the event of death, terminal illness or total permanent disability. It is automatically extended to you upon your first CPF working contribution.

Term insurance policies are a cost-effective way to ensure protection, especially when lower premiums are “locked-in” at a younger age.

Premiums for term insurance policies are usually cheaper compared to whole life insurance policies, for the same level of protection. This is because most term insurance policies only provide insurance protection and do not have any investment element (i.e. no surrender value).

For more affordable options, explore:

-

Group term insurance policies (e.g. MINDEF & MHA group term insurance policies applicable to Full-time National Servicemen and their dependants); and

-

Direct Purchase Insurance. No commission is charged as this option does not come with any financial advice.

|

Learn more about DPS here |

/insert QR code go.gov.sg/dps |

|

Compare premiums and features of insurance products at compareFIRST |

/insert QE code go.gov.sg/compare |

CPF and your retirement

Your CPF savings help to prepare for your retirement from the moment you begin working. Grow your retirement savings by making cash top-ups and/or CPF transfer to your CPF Special/Retirement Account. You can enjoy up to $8,000 in tax relief on your cash top-ups and receive higher monthly payouts due to compounding interest when you retire!You should start investing to grow your wealth too. Take advantage of your long time horizon and the power of compounding interest

|

Learn more about CPF top-ups |

/insert QR code go.gov.sg/cpftopups |

Home purchase

For many Singaporeans, a home will be the largest purchase and investment that one will make. It is important that you plan your finances and budget for a flat purchase carefully with HDB’s ABCs of financial planning and financial tools.

|

Find out more from HDB's comprehensive guide |

/insert QR code go.gov.sg/buyhdb |

Investments

An important aspect of investing is understanding your own circumstances and the product before you put your money in it. Considerations include your financial goals, needs, investment horizon, risk appetite and budget, as well as the product’s features, terms, benefits and risks.

Every investment bears risk. In some cases, you could lose some or all of the money you invested. Bear in mind that there is no free lunch - the higher the potential returns, the higher the risks!

For lower risk products, you may consider Singapore Savings Bonds, T-bills and fixed deposits that are capital guaranteed by the Government or banks.

Diversification is a way to manage investment risks, by allocating funds across different asset classes (e.g. stocks and bonds), different industries and different countries.

There are diversified investment products such as Exchange Traded Funds (ETFs) and/or Unit Trusts (UTs),which can help you spread your investment across different asset classes, industries and countries. There are also bundled products which have both investment and protection elements. Examples of such bundled products include whole life policies, investment linked policies (ILPs) and endowment plans.

Pay attention to the fees and charges incurred when purchasing investment products as these will reduce your returns. You are also strongly encouraged to purchase investment products through MAS regulated financial institutions.

|

Learn more about how to build an investment portfolio that meets your needs here! |

/insert QR code go.gov.sg/investments |

|

Refer to MAS Financial Intitutions Directory for a listing of the financial instituitions regulated by MAS |

/insert QE code go.gov.sg/regulatedfis |